Company registration in Costa Rica

Registering a company in Costa Rica means no taxes on profits, dividends, or royalties earned abroad. It's the perfect choice for international holding companies and trading companies: tax savings combined with reliable asset protection.

Cost of registering a company in Costa Rica

Cost: from € 4 500

Timeframe: up to 10 days from the date of submission of the complete set of documents.

Advantages

Short timeframes, a simple reporting format, and economic benefits make company registration in Costa Rica an excellent option for entrepreneurs. An important advantage is the ability to register a business remotely — visiting the country in person is not required.

Requirements

-

1

Obtain confirmation from the person who will serve as the company’s director.

-

2

Have a legal address in Costa Rica.

-

3

Provide detailed information on who will own the company’s shares and in what proportions, including the ownership percentage of each shareholder.

-

4

Provide three potential company names.

-

5

Provide the full name, nationality, marital status, occupation, and address of shareholders and directors, along with scanned copies of their passports.

Additional documents or originals of the above may be required. Prepare all necessary materials in advance to provide them promptly upon request.

Leave your contact details. Our expert will contact you within 30 minutes and will advise you on your question.

Sign up for a consultation! Choose a time and date convenient for you.

Stages

The service package includes registration of a local legal address for the first year of the company’s operation and secretary services for up to one year.

Additional Services

paid separately

- Our clients have access to paid support renewal. It includes the annual renewal of the legal address, company activities, and secretary services.

- Opening of personal and corporate bank accounts

- Accounting support

Is it possible to completely waive tax and financial reporting if all company activities are conducted outside Costa Rica?

Is it available for companies registered in Costa Rica to open an account in a neobank?

If you want to complete the remote business registration procedure in Costa Rica quickly and successfully, leave a request. We will guide you through all the stages, prepare the registration application and all necessary documents considering all the nuances of local legislation. Without your presence, we will obtain confirmation of successful registration and send the apostilled documents directly to you by courier. Hundreds of successful cases and many grateful clients are the most convincing proof of our professionalism.

Cases:

CASE: How to recover frozen $600,000

The client faced a problem with frozen funds in the account of his international company. The bank where the account was held was in the process of liquidation and froze all funds while starting an audit of its clients.

Read more

CASE: Forgotten $400,000

Our client decided to completely liquidate his company, established about 10 years ago in Latvia. During the liquidation process and communication with the bank, we discovered that the client had $400,000 in the account for several years — money everyone had forgotten about.

Read more

In the video, we explain how Intelligent Solution Group can be beneficial for your business

Intelligent Solution Group – is

Company registration and support services:

- company registration;

- business relocation;

- company renewal.

International tax planning.

Banking services:

- passing Compliance, KYC, SOF in a bank;

- opening bank accounts;

- opening accounts in neobanks (payment systems);

- source of funds verification;

- fund release from frozen accounts.

Licensing:

Accounting and audit services for international companies.

Assistance in obtaining citizenship by investment, permanent or temporary residence, second passport.

Succession and inheritance planning for wealthy families.

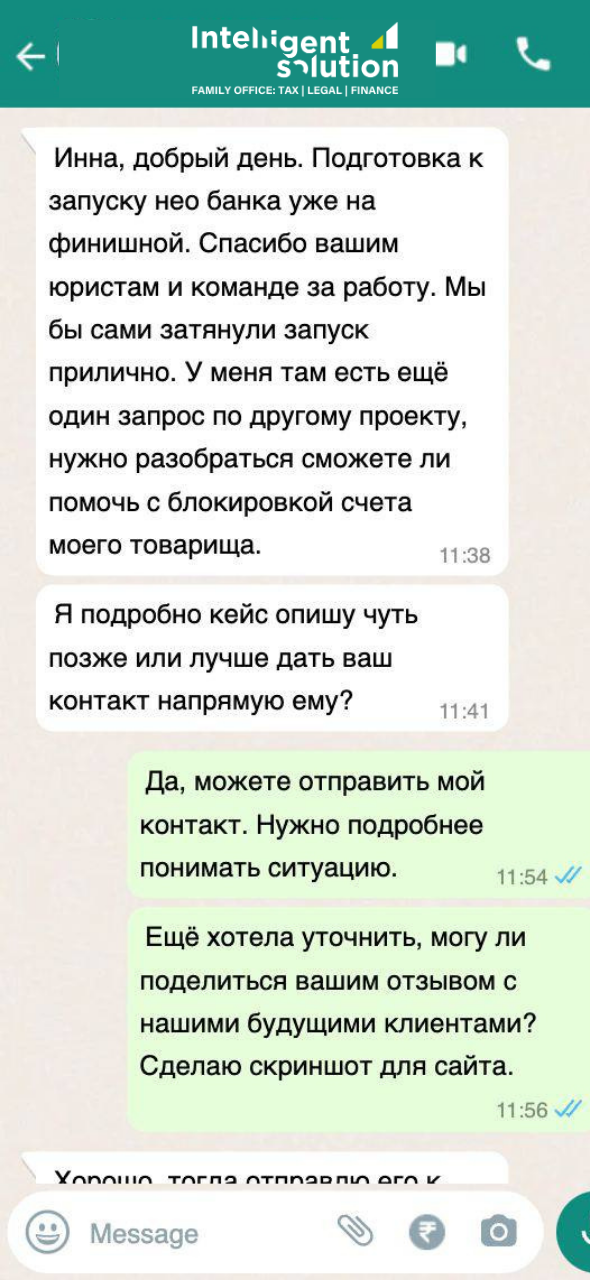

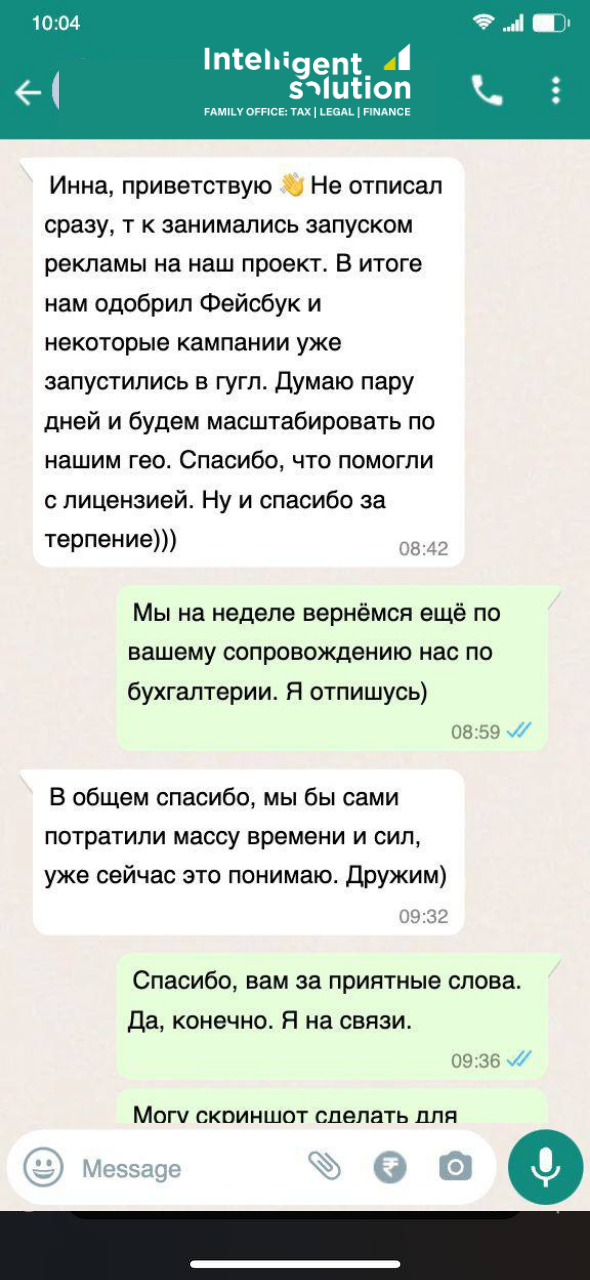

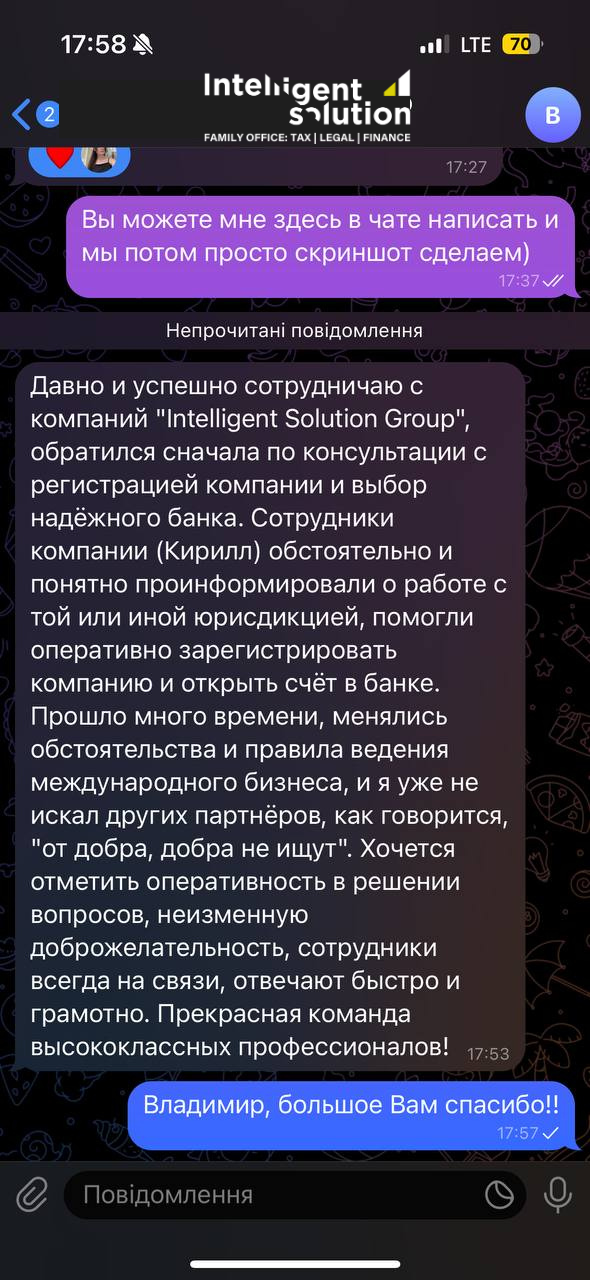

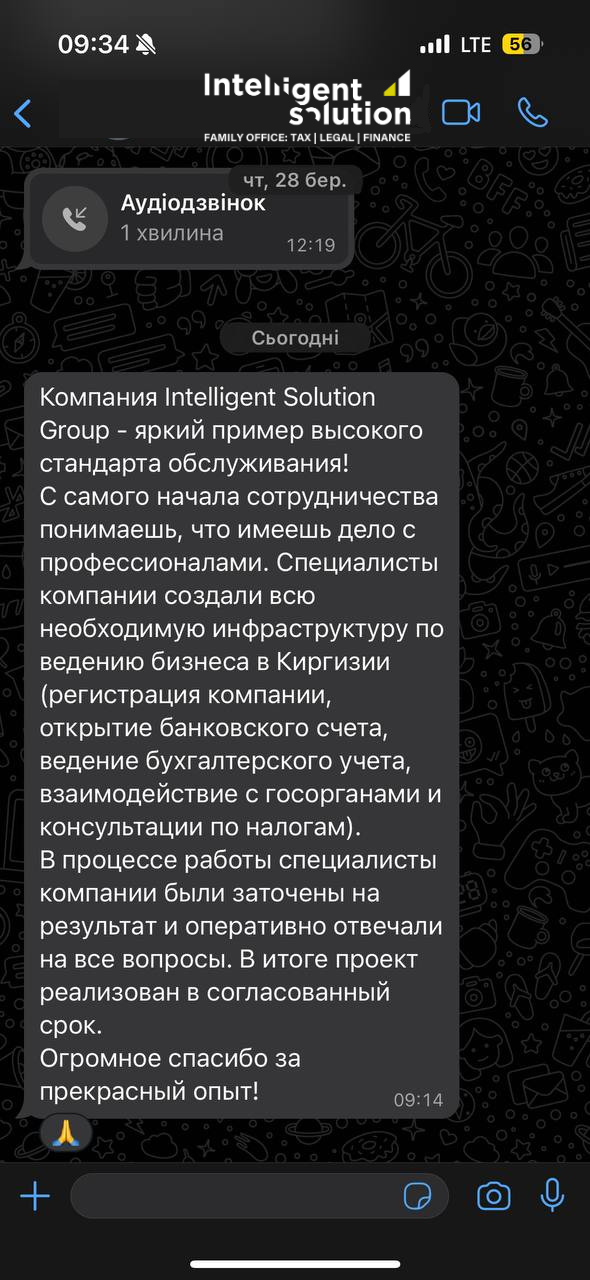

Reviews