Company registration in Panama

Registering a company in Panama provides access to international markets, tax advantages, and reliable asset protection.

Company registration cost in Panama

Price: from € 3 350

Timeframe: about 10 business days

Advantages of opening a company

International companies that do not operate within Panama are exempt from corporate income tax.

Requirements

-

1

Declared share capital of USD 10,000 (no need to deposit).

-

2

At least one shareholder.

-

3

At least three local directors.

-

4

Presence of a registered agent.

-

5

Legal address in Panama.

-

6

Notarized documents of the founders.

These requirements make the company registration process in Panama clear and accessible for international entrepreneurs.

Required documents

- a copy of the international passport and a copy of the national ID with translation (notarized and apostilled);

- proof of residence address;

- a reference letter to confirm reliability, absence of debts, and low risks;

- completed KYC forms.

Depending on the risk assessment, additional documents may be required:

- proof of income;

- a letter from the employer or a statement from the accountant;

- tax declaration;

- bank account statement for the last 12 months;

- investment portfolio statement for the last 12 months;

- financial statements.

Leave your contact details. Our specialist will contact you within 30 minutes and provide a consultation on your inquiry.

Book a consultation! Choose the most convenient time and date for you.

Steps

We provide annual company renewal services, prepare powers of attorney through a lawyer, issue a Certificate of Good Standing, and offer nominee director services.

Additional services

charged separately

- We assist in opening personal and corporate bank accounts.

- We prepare financial and accounting reports.

How long does company registration in Panama take?

Is personal presence required to register a company in Panama?

Cases:

CASE: How to recover frozen $600,000

The client faced a problem with frozen funds in the account of his international company. The bank where the account was held was in the process of liquidation and froze all funds while starting an audit of its clients.

Read more

CASE: Forgotten $400,000

Our client decided to completely liquidate his company, established about 10 years ago in Latvia. During the liquidation process and communication with the bank, we discovered that the client had $400,000 in the account for several years — money everyone had forgotten about.

Read more

In the video, we explain how Intelligent Solution Group can be beneficial for your business

Intelligent Solution Group – is

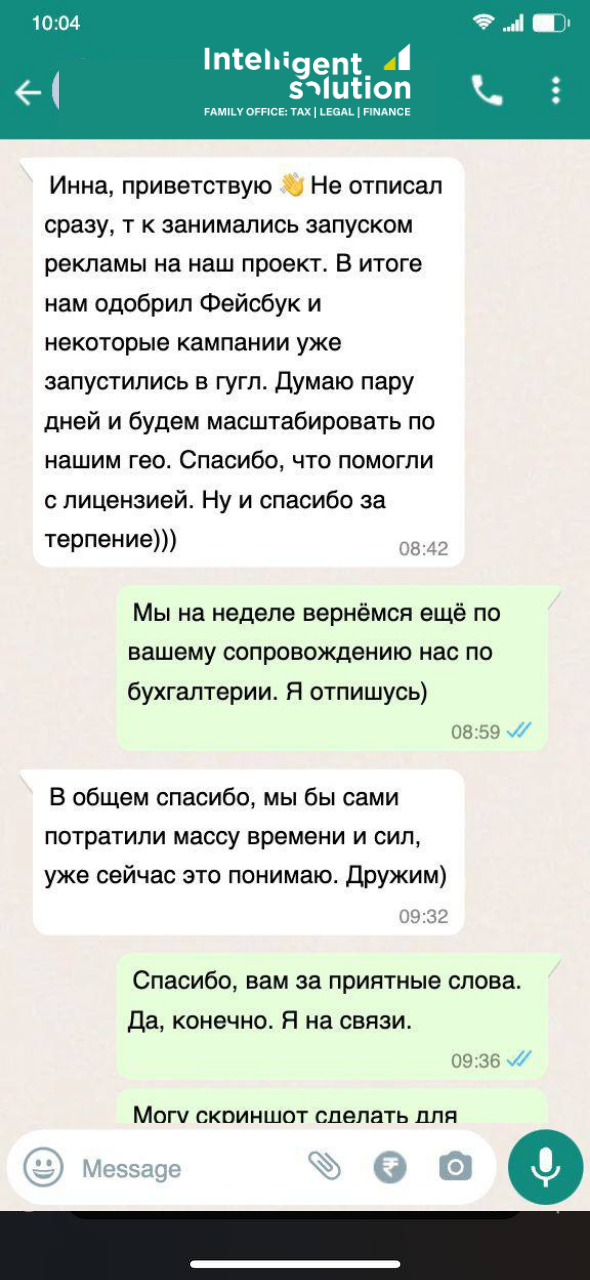

Company registration and support services:

- company registration;

- business relocation;

- company renewal.

International tax planning.

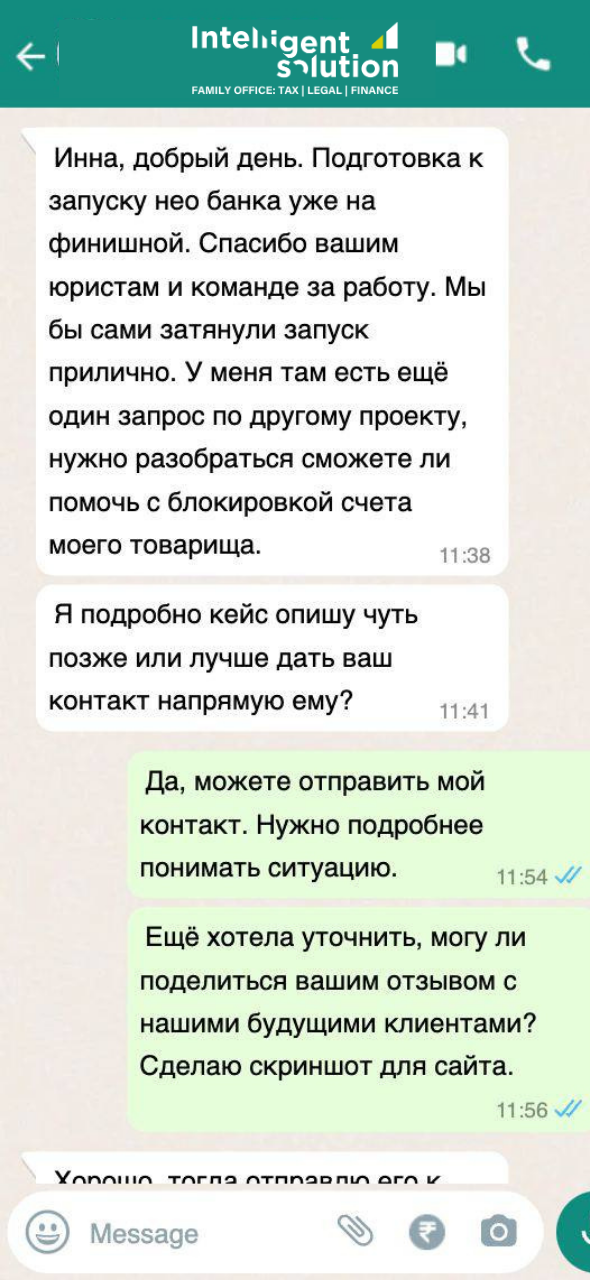

Banking services:

- passing Compliance, KYC, SOF in a bank;

- opening bank accounts;

- opening accounts in neobanks (payment systems);

- source of funds verification;

- fund release from frozen accounts.

Licensing:

Accounting and audit services for international companies.

Assistance in obtaining citizenship by investment, permanent or temporary residence, second passport.

Succession and inheritance planning for wealthy families.